Essentials of Investing

Financial Wellness Sidebar Menu (Not Blog)

Here are some of the key concepts you should understand before you start investing.

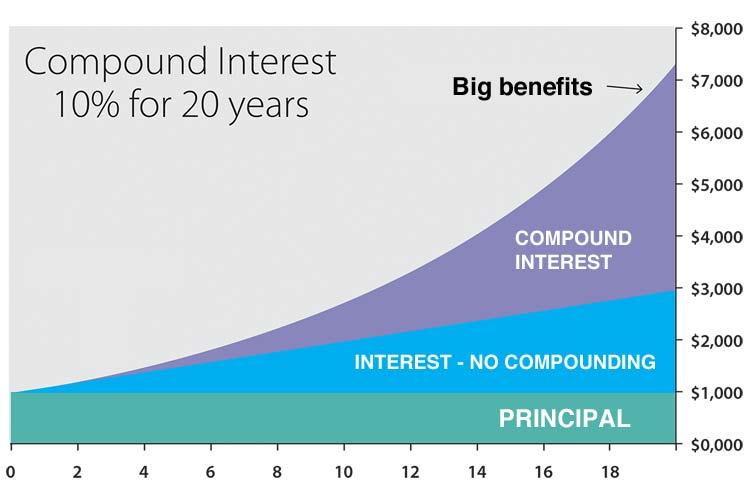

When investing, accounts earn compound interest, meaning the combined value of your principal amount and your accrued interest earns additional interest. Learn more about compound interest on Investopedia.

Compound interest is important because, compared to simple interest, it can give you much greater returns over an extended period of time. The graph below demonstrates two different accounts: one earning simple interest and one earning compound interest with the same principal deposit.

The combination of compound interest and time can lead to a greater return in your wallet later in your life. Even if you only have a small amount of discretionary income, investing early can be one of the most rewarding financial decisions you ever make.

There is no shortage of theories from professional experts on the best way to invest your money, and countless sources of information explaining the mechanics of markets and how they function. There is a reason why so many people are intimidated by this topic. To get you started, we’re going to explain the concepts that are most relevant to you while you’re young and provide you with the tools to learn more when you’re ready.

Investing can happen in a variety of ways, but at this point, you should have a foundational understanding of stocks and bonds. It takes a lot of time and effort to individually seek out stocks and bonds, also known as active investing. Instead, you may choose to passively invest, by using investment vehicles that do the work for you, like buying into a mutual fund or exchange-traded fund.

Small pieces of a company that you can purchase, making you the owner (or shareholder) of that small piece. The value of a stock depends on the performance of the company represented in your share. When the company performs well, your stock’s worth grows. When the company performs poorly, your stock’s worth shrinks.

Loans that you issue to some entity, whether a business, bank, or government, with promised repayment including interest after a certain time period. Bonds have fixed rates, so you can accurately predict how much you will receive at the end of its term, assuming the bond is with a reliable source (like the federal government).

Investments shared by a group of people. Many investors contribute money to a pooled mutual fund, which is then invested in a variety of stocks, bonds, and other assets. The investments are managed by a fund manager, who actively buys and sells assets to help the investors profit.

Like mutual funds, ETFs invest your money into a variety of asset types but are different because they are traded on exchanges like stocks. Most ETFs are passively managed, so they attempt to match a market index (like the S&P 500 or Dow Jones). ETFs typically have lower costs than other investments, as they are more hands-off and have low or no minimum investment amounts.