Private Alternative Loans

SRFS Sidebar Menu

SRFS Below Traversable

Private Education Loans

Private education loans are non-federal, credit-based loans offered by banks, credit unions, state agencies, and private education loan providers. These loans can help cover educational expenses that may remain after all other forms of financial aid have been applied not to exceed your Cost of Attendance.

Beginning with the 2026–2027 academic year, The University of Pennsylvania (Penn) has implemented Preferred Lender Arrangements in response to recent changes in federal loan program regulations that take effect on July 1, 2026. These regulatory changes have created a need for private loan funding options that will ensure that Penn students and their families can continue to access needed financial resources.

The primary objective of these Preferred Lender Arrangements is to provide private educational loans that address funding gaps for students who have already received the maximum allowable federal loans. Additionally, these arrangements will offer private loan opportunities for parents who choose to borrow funds to cover eligible educational expenses for their children. The envisioned private loan programs will be accessible to all undergraduate and graduate students enrolled in academic programs across the university. This includes specialized offerings for international students, health professions students, and those in non-health professions programs.

To achieve these goals, Penn has undertaken a systematic and carefully tailored initiative to establish its Preferred Lender Arrangements. While the process has been customized to meet the university’s unique needs, it fully adheres to all federal regulations governing such arrangements. Throughout the development and implementation phases, Office of General Counsel’s Associate General Counsel and Student Registration and Financial Services' Director of Compliance and Training have been actively involved to ensure that every aspect of the program satisfies federal regulatory requirements.

For additional information on The University of Pennsylvania's Preferred Lender Arrangement Process, click here.

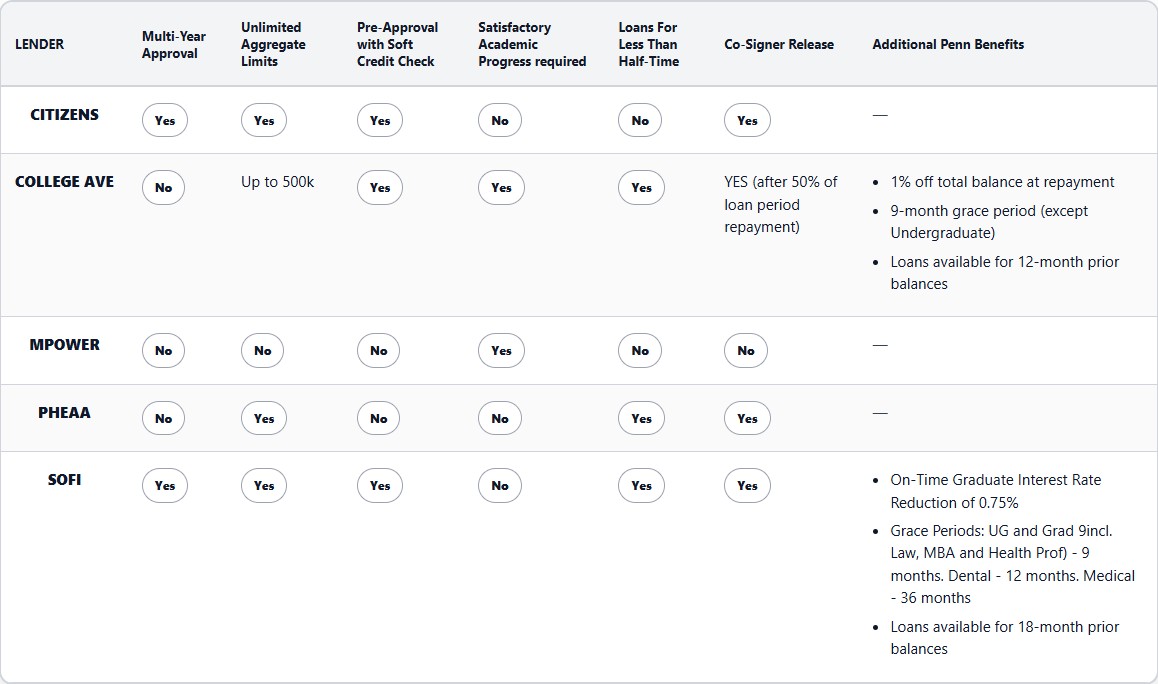

Below is a chart that compares the five private loan programs with which Penn has entered into a Preferred Lender Arrangement. This chart illustrates a sampling of the loan program terms and conditions being made available to Penn students and parents. Please review the chart prior to continuing your research on ELM Select. This chart will provide you with preliminary information that will assist you in determining which loan program is the best fit for your borrowing needs. Once in ELM Select, you will be able to compare again eligibility criteria and terms and conditions for each of the five preferred lenders and you will be able to make a more informed decision about which program is best for you.

Before considering a private education loan, it is important that all students review and exhaust their eligibility for federal student aid, including grants, work-study, and federal loans. To apply for federal aid, students must complete the Free Application for Federal Student Aid (FAFSA) at https://studentaid.gov. You can also visit the site to learn more about your eligibility and explore available federal aid programs.

How to Use ELM Select:

- Click here to access ELM Select

- Select your academic program

- Click “View Loans” to see available options

- Compare lenders and loan products

- Click “Apply” when you’re ready to proceed